Blobs Are In Price Discovery. Could We Hit a Blobspace Tipping Point?

Blobs are in price discovery. With a bull market getting started, how much scarcer will blobspace get? And what will it mean for fees?

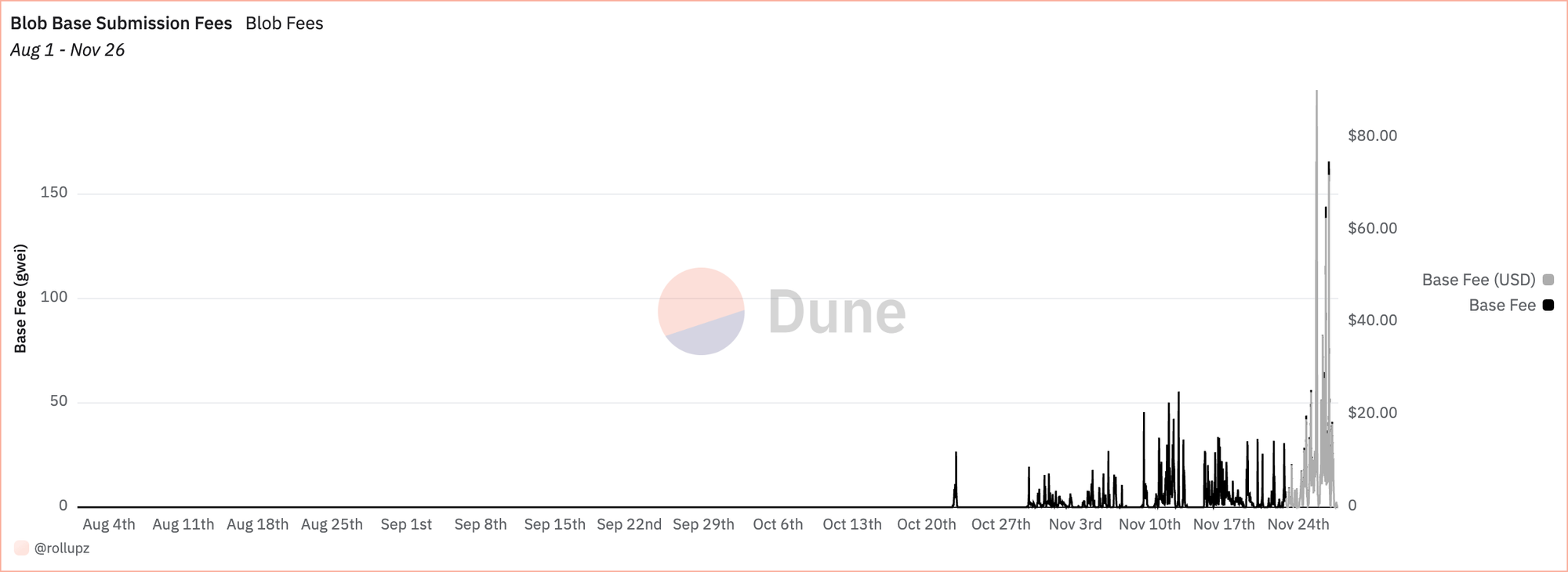

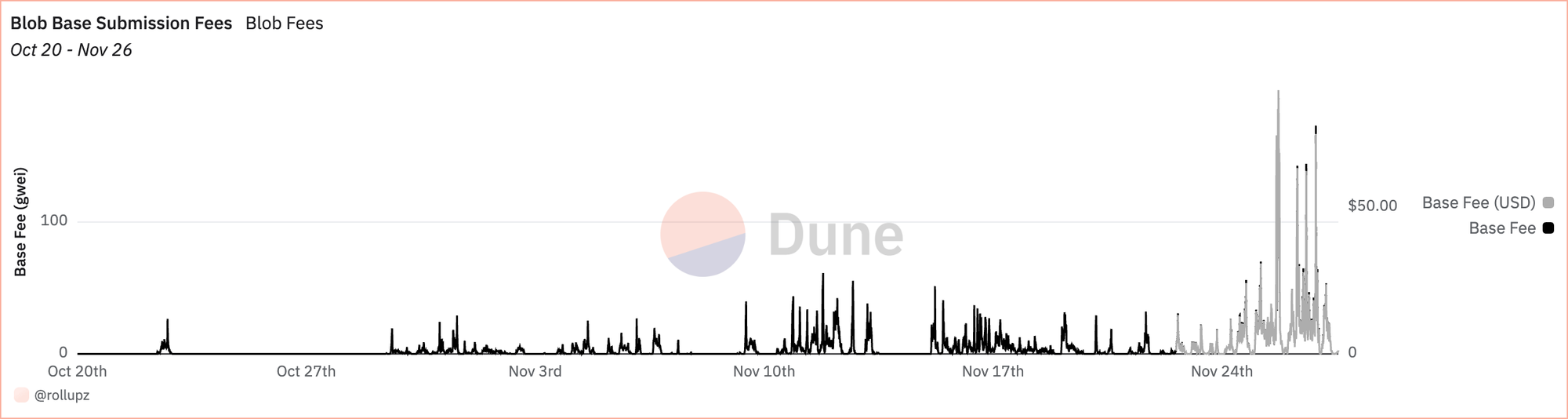

For the last few weeks, Ethereum blobs have been in price discovery. Blobspace is getting scarcer, and for the first time since April 2024, a few weeks after blobs first launched with EIP-4844, we’re seeing sustained periods of base fees above $0.

Source: Dune, Forked from Hildobby

So far, rollups posting Ethereum blobs don’t appear to be heavily impacted, as the rise in blob fees is relatively small compared to rollup revenue. But with a bull market getting underway and more rollups set to launch in the near future, how much scarcer will blobspace get? And will blob fees rise to the point that chains’ profitability is impacted, or that users are scared off by resulting transaction fees? We’ll analyze the current blobspace situation more closely below, and see about what increases in rollup activity could mean for blobs.

Background: How much blobspace is there and how are blob fees calculated?

Each Ethereum block has a target number of 3 blobs, and a hard limit of 6. So, at Ethereum’s 12-second block times, basic math tells us the following:

The target number of 3 blobs per block is enforced with a fee formula that exponentially raises the base fee to submit a blob with each consecutive block that contains more than 3 blobs. The more excess blobs, the greater the increase – if the current block has 6 blobs, the next one will have a much greater increase than if it had 4. And likewise, a block with 0 blobs will decrease the price more sharply than a block with 3 blobs.

By continuously raising the costs in this way, the EIP-4844 fee mechanism incentivizes blob submitters to submit only enough blobs such that the average block doesn’t have more than three in a given time period.

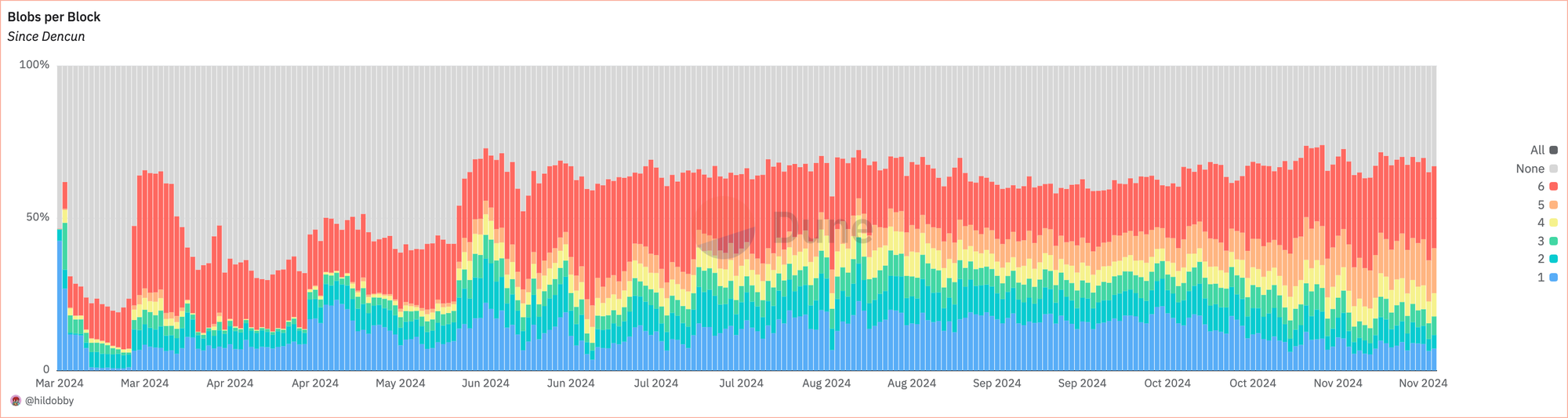

Under these incentives, most blobs in practice have either 0 blobs or the maximum of 6 blobs.

Source: Dune, Hildobby

The fee mechanism has been moot for most of blobs’ history though, as blob submissions have been low enough that it’s rarely triggered – until recently.

Blobs in November 2024: Blobspace shrinking, fees rising, but little impact rollup profitability yet

Since roughly October 29, blobs have been averaging exactly three blobs per block on a daily basis, occasionally crossing the limit to 3.1. Prior to then, the average was well below 3 without any need for intervention.

Source: Dune, Hildobby

However, with blob demand increasing, the EIP-4844 fee mechanism has kicked in to ensure that blocks maintain the three blob average.

Source: Dune, Forked from Hildobby

We see here that blob base fees began a sustained rise around October 29, started increasing more around November 9, and then has seen huge spikes since roughly November 24.

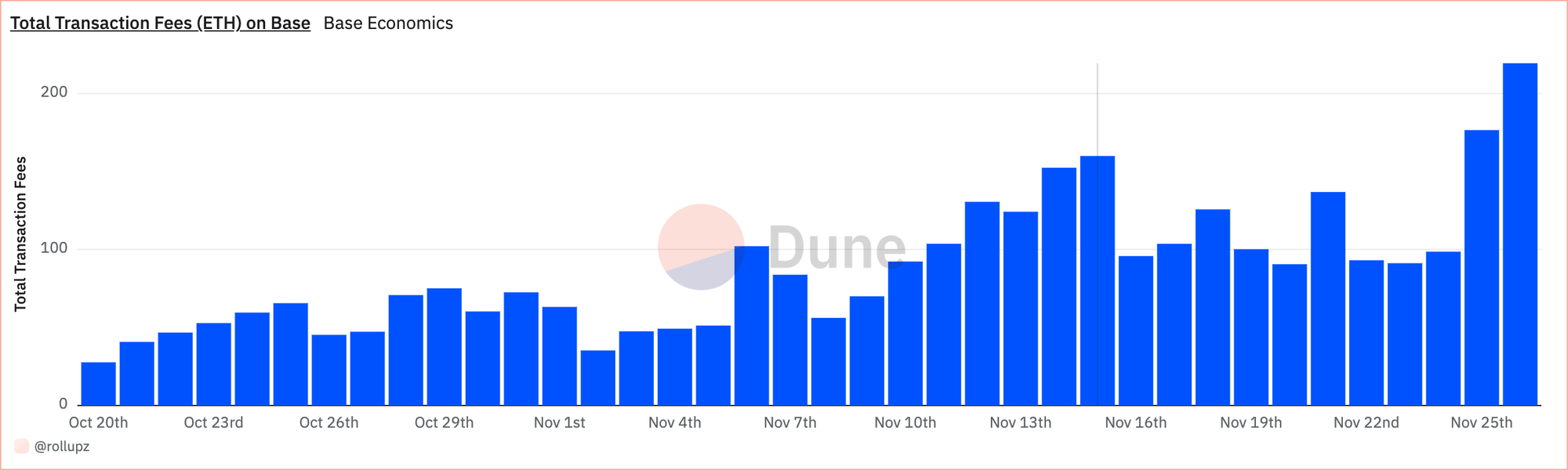

For the first time, rollups have to pay for blobs. But is this actually affecting them from a business standpoint? We’ll look at Base as an example since it’s the biggest blob user.

From the user’s point of view, fees on Base have indeed increased during the Blobs price spike.

Source: Dune, Forked from jhackworth

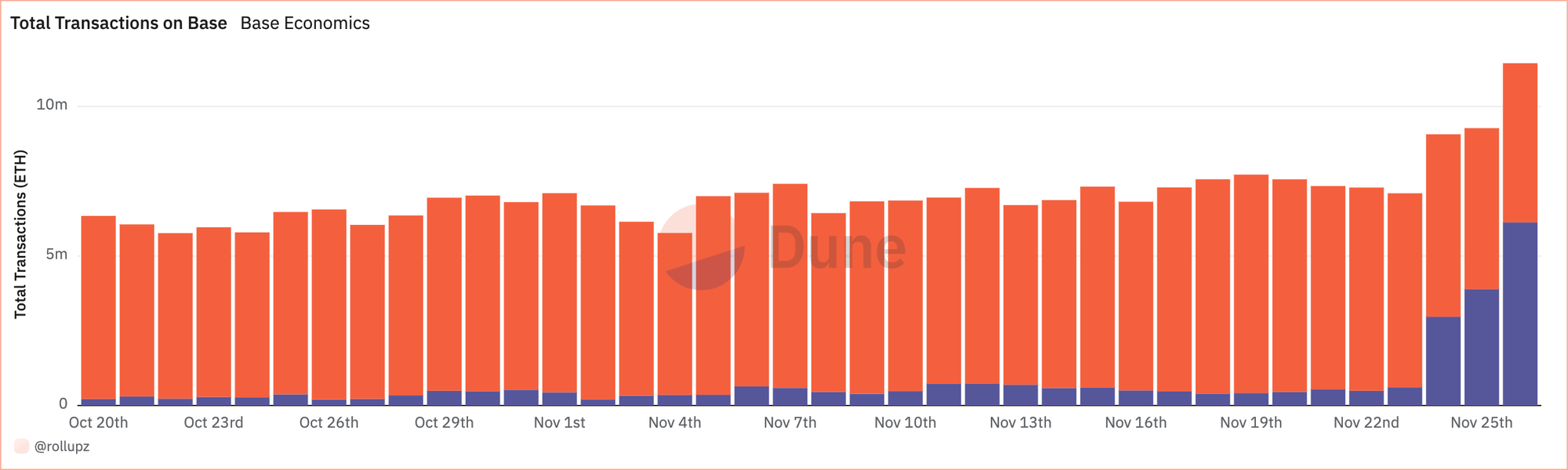

This has also coincided with Base reaching all-time highs on transactions. However, more and more of those transactions were failing starting around November 24 – more than half failed on the 26th, in fact.

Source: Dune, Forked from jhackworth

Throughout this time period, fees per transaction have remained flat overall — but fees per successful transaction have spiked due to the increase in failed transactions.

Source: Dune, Forked from jhackworth

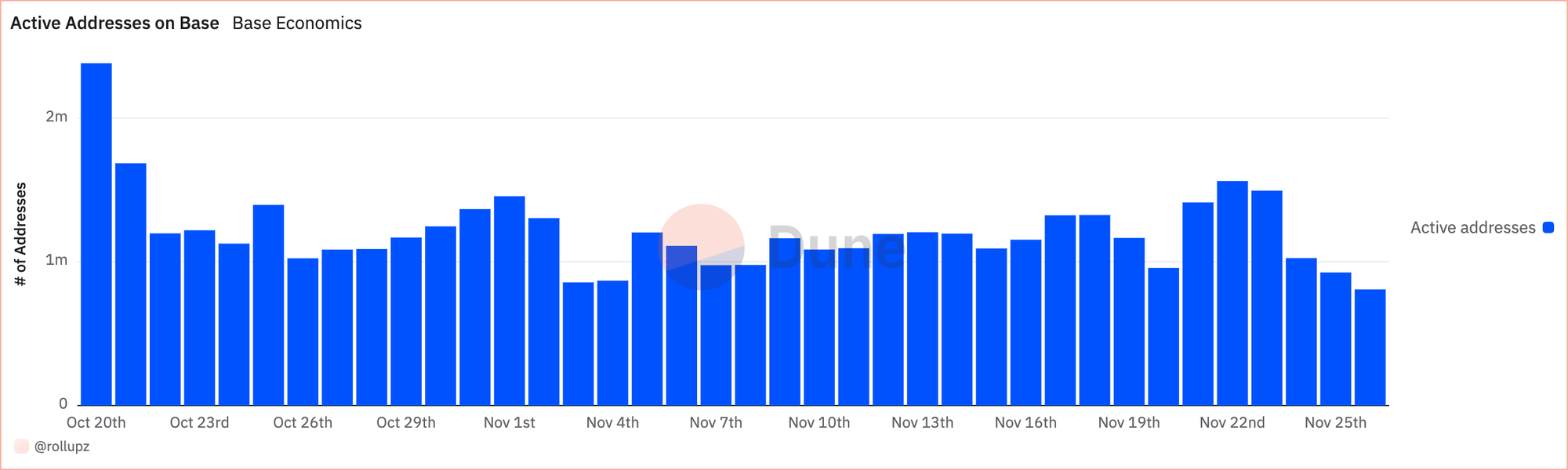

However, while fees have increased significantly on a percentage basis, in raw numbers they’re still low — at their November 26 peak, fees per successful transaction were still around $0.15, and roughly $0.07 per transaction overall. Active addresses on Base remained high during the initial transaction fee increase, but have begun to drop around the 24th, when failed transactions rose – that, rather than fees themselves, may have been the cause for the decrease.

Source: Dune, jhackworth

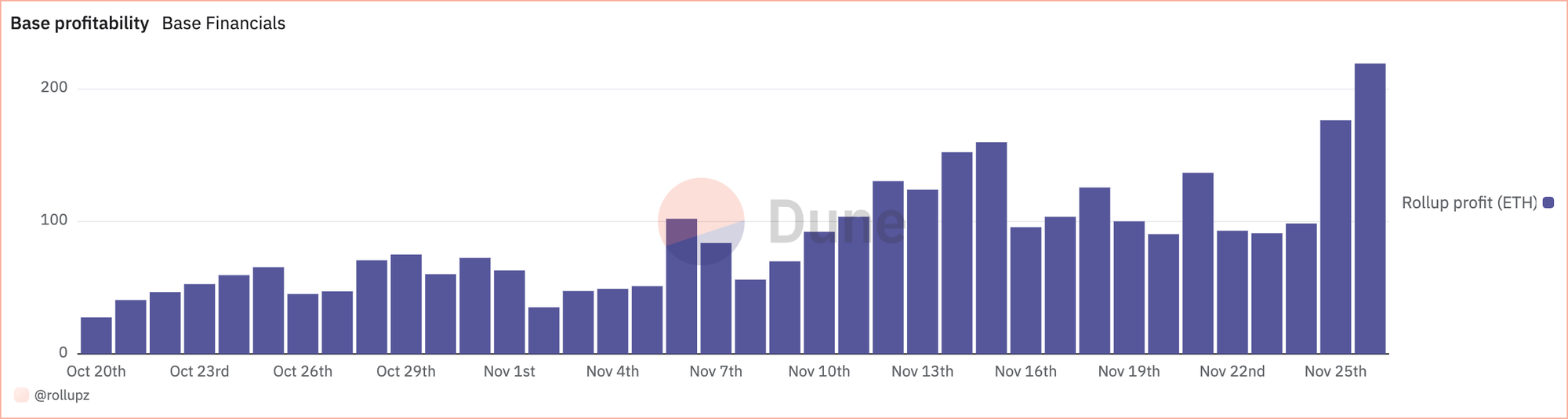

From a financial standpoint, Base’s profitability has actually increased during this period of higher blob fees, including in days when failed transactions rose.

Source: Dune, Forked from thechriscen

The increase in costs from blob fees have been more than offset by increased fees from users, and so far. While active users have decreased some, transaction volume remains high enough for the chain’s profitability to grow. Other rollups that post blogs also appear to be making out well. Ultimately, the increased blob fees are small compared to revenue and transaction volume.

Will blobspace reach a tipping point?

While the blobspace situation is stable for now, is it possible that we’ll reach a tipping point at which fees get too high for users and rollup profitability is impacted? It’s difficult to say. However, we can imagine hypotheticals to estimate what different increases in activity would mean for available blobspace.

As we mentioned earlier, Base is consistently the leader in blob submissions, though other rollups contribute a significant amount. Here’s how the numbers work out on an hourly basis.

Source: Dune, Forked from Hildobby

In one hour, there are 300 blocks and a maximum total of 1,800 blob slots, with a target utilization of 900 blob slots. During the time period from November 24 through November 26, when blob fees have spiked to their highest ever levels, the average number of blobs per hour was 899.0, which puts us one blob under the target average of 3 blobs per block, and well under the hard limit of 6. 363.9 of those blobs per hour, come from Base — roughly 40% of the total. That should give you an idea of how much the biggest blub submitters drive the blobspace market.

Now for the hypotheticals. During the November 24 to November 26 time period we’re focusing on, Base transactions rose 37%, and Base’s blob posting rose by 13%. What if Base’s blob posting went up by another 13%? Base would be posting 411.2 blobs per hour. If every other rollup stayed flat, that would mean a total average of 946.3, or an hourly average of 3.15 per block – over the target, and more than has ever been sustained for an entire day. If all rollups increased blob posting by a uniform 13%, then we would reach 1,015.9 blobs per hour, or an hourly average of 3.4 per block.

We would expect the fee mechanism to force blob usage down below these levels over a three-day time period, but this would require blob fees to go even higher.

There’s also the question of new rollups. Unichain, for example, will be coming to mainnet soon and using Ethereum blobs. Others are likely to follow, especially if the bull market continues.

What would happen if another blob submitter the size of Base came on the scene? If another rollup popped up and began matching Base’s 363.9 blobs per hour, and nothing else changed, we would have 1,262.9 blobs per hour, or an average of 4.2 per block. We’ve never reached an average of 4.2 blobs per block in any single hour since blobs began.

This would require an even bigger increase in fees to force blobs down below the target.

However, it’s worth noting that even under such an increase, we could still avoid sustained periods of multiple consecutive blocks above the blobs target of 3 per block. This is important because the fee mechanism is designed to increase exponentially based on the previous block’s number of blobs above the target. Even in the scenario above where we average 4.2 blobs per block, on an hourly basis we could still max out every other block with 6 blobs, and have the remaining 150 blocks stay below the target at an average of 2.4 per block. Theoretically then, we could avoid ever having consecutive blocks above the blob target. At 1,350 blobs per hour though, this would no longer be possible.

Large blob fee increases possible

While it’s hard to predict with certainty, we believe the numbers point to several feasible scenarios in which blob fees rise significantly. The question is whether those increases are significant enough to scare off users and eat into rollup profitability.

The good news though is that rollups have other options. Alt DA providers like Celestia can provide cheaper data availability than Ethereum blobs, and may be better equipped to adjust their protocols to increased activity if necessary.